Central banks are under pressure to rapidly raise interest rates to contain inflation

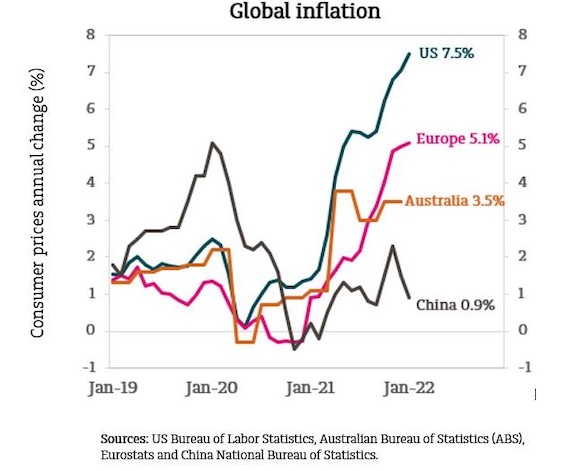

Global inflation has surged over the past year. The prime example is the US consumer price index (CPI) which shows annual inflation at its highest level in the past four decades at 7.5% in January 2022. Europe has also struggled with rising prices with annual inflation above 5%. Australia has experienced a more moderate 3.5% annual inflation in the year to December 2021. Yet this is minimal solace to Australian consumers who have seen their household budgets squeezed at weekly visits to the supermarket and petrol pump. The only remarkable exception to this global inflation surge is China, where consumer prices have risen by only 0.9% in the past year.

Consumers and central bankers appear to have been blindsided by inflation. For most of the last year, the consensus was that rising inflation was only ‘transitory’. The pandemic seemed to be causing massive but temporary disruptions to both demand and supply in the global economy. For demand, government support payments such as ‘JobKeeper’ had temporarily boosted consumers’ disposable income. For the supply side, there was dramatic disruptions as the pandemic lowered production and resulted in shortages of key goods and services. The clearest examples of these supply shortages were seen in computer chips and transport ships. Hence the ‘price to pay’ for stronger global demand with reduced supply was higher prices. Yet this inflation surge was viewed as temporary as the impact of government stimulus would fade and supply chain problems would moderate over time.

However, this confidence that rising inflation is ‘transitory’ has now broken down. Supply chain problems have been persistent as witnessed by new car buyers having to wait months for delivery. Producers are paying higher prices for key commodity prices ranging from aluminium to zinc. The best example of this persistent price pressure is that the oil price has risen by 62% in the past year. Also concerning is that the range of large price rises has now broadened to include housing rents and building costs. Hence inflation is a clear and present danger to consumer’s financial wellbeing as well as the credibility of central banks.

Central bankers are now waking up to the inflation threat as their new primary concern.

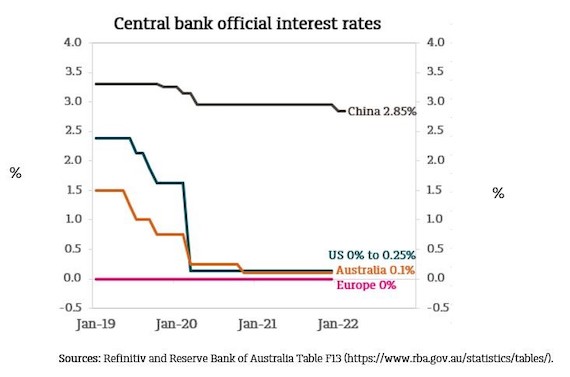

Given the pandemic, official cash interest rates set by the US, Australian and European central banks have fallen to effectively 0% since early 2020. These are extraordinarily low interest rates which are well below inflation.

In the past two months, some central banks have conceded that official cash interest rates need to rise. The US Federal Reserve (Fed) is now signalling concern about the upside “risks to inflation” given further disruptions to “supply chains (and) the possibility of geopolitical turmoil that could cause increases in global energy prices or exacerbate global supply shortages”.1 Financial markets are expecting US interest rates to start rising in March 2022. There is likely to be a rapid sequence of interest rate rises that pushes the US official interest rate from 0.1% to 1.6% by the end of this year.

While the Australian and European central banks have indicated a preference to be ‘patient’ on raising interest rates this year, these central banks concede the case for higher interest rates is becoming “plausible”. China is once again the exception as low inflation has allowed their central bank to cut interest rates by 0.1% to 2.85% this year.

By raising interest rates, central banks will aim to moderate price pressures. This can be achieved through a mix of slowing consumer demand to meet the limited supply available and keeping inflation expectations in check to curb rapid increases in production costs and wages. Arguably central banks have been too relaxed in responding to this current inflation acceleration. The lesson of the last great inflation surge in the 1970s that being ‘patient’ with low interest rate settings when inflation is surging means that the central bank’s task becomes even harder. Hence there is a ‘need for speed’ on raising interest rates. As the old saying goes, “a stitch in time saves nine”.

Contact us on 02 9554 3566 to find out more about the changes to inflation.

1 US Federal Reserve meeting minutes, 26 January 2022.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (‘MLC’), part of the Insignia group of companies (comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’).

An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs.

MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice).

MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance.

This information is directed to and prepared for Australian residents only.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.