Disposing of shares

How to dispose of shares You can dispose of your shares in the following ways: selling them giving them away (gifting shares) transferring them to

How to dispose of shares You can dispose of your shares in the following ways: selling them giving them away (gifting shares) transferring them to

What is your ‘estate’? Your ‘estate’ includes everything you own – your ‘earthly possessions’, if you will. It can include for example cash, property, cars,

Why the decision to keep deeming rates on hold may be a window for interest rates. In delivering the second reading of the Appropriation Bill

Average household wealth, and what it takes to rank among Australia’s wealthiest 1%. Being a billionaire isn’t what it used to be. Back in 1990,

Discover why having a core-satellite approach to your portfolio is a powerful investment tool. What is a core-satellite strategy and why is it so powerful?

If you have more than one loan, it may sound like a good idea to roll them into one consolidated loan. Debt consolidation (or refinancing)

Key takeaways Insight into the various pros and cons of each of the three main options for your retirement savings – account-based pension, lump sum,

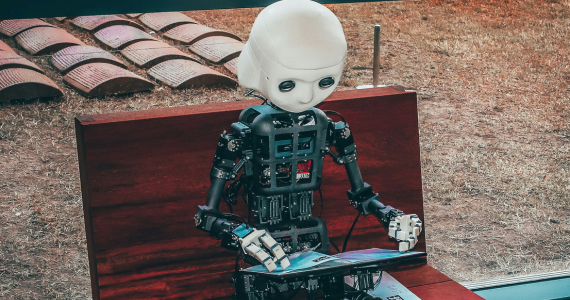

Key takeaways How Artificial Intelligence (AI) is currently being used to shape investment decisions, with applications such as sentiment analysis and algorithmic trading. The AI

As our family members or friends get older, it’s normal to worry about them and want to help. But it’s not that easy to know

Tax breaks are always good news, but for house hunters they can have an added bonus. Not only do tax cuts mean potential buyers have

Kingsgrove Office

Suite 1A, Level 1,Concord Office

Suite 28, Level 2,Mon - Fri: 9am - 5pm

Sat - Sun: Closed