Key takeaways:

-

There are some sources of income that provide better protection against inflation such as government benefits, rental income, dividends and commodities

-

It’s important to avoid making rash decisions like shifting to a more conservative investment approach when sharemarkets are falling

-

It’s worth speaking with a financial adviser as they can review your overall investment performance and allocation to make sure it aligns with your goals.

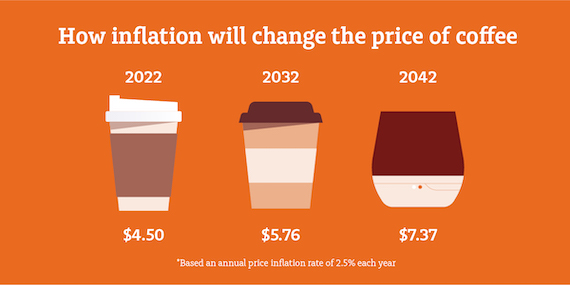

With prices rising on most things like food, housing, and utilities, you may be worried about the impact of inflation on your retirement.

Add a volatile sharemarket to the mix and you might even be rethinking your investment plans.

But there are things you can do to help soften the blow.

In this article we look at some sources of income which can help protect you against inflation and things you can do to curb its effects on your retirement savings.

Sources of income that protect against inflation

Once you’re retired and start living off your retirement income, inflation reduces your spending power. But there are some sources of income which provide better protection against it.

-

Government benefits: the Age Pension and allowance rates are indexed twice a year. This helps retirees keep pace with the rising cost of living

-

Rental income: this is often a strong income source during higher periods of inflation as landlords can decide to raise the rent at the end of a lease term

-

Salary or self-employed income: retirees with a part-time job, side hustle, or working for themselves can generate higher income to counteract inflation

-

Dividends: while companies may not always pay the same amount of dividends during times of high inflation, it can still provide a good income source.

Then, there are other sources of income that may not protect you so well against inflation.

-

Cash/savings: the value of cash can decrease with inflation as it’s not a growth asset.

What you can do to curb the effects of inflation

1. Avoid making rash decisions

It’s important to remember that your retirement savings are designed to be long-term, providing income to support you throughout retirement (for some people that’s four decades).

While you may be tempted to shift to a more conservative investment approach when sharemarkets are falling, it could lead to emotional decisions that affect your retirement savings such as, locking in losses and potentially missing out when the market rebounds.

2. Invest

Having your money invested in a well-managed and diversified investment option that has some level of risk, may help you earn enough to beat inflation.

Interest rates rarely keep up with inflation, so depending on your circumstances, having all your money in cash may not be the best approach.

3. Diversify

Your investment portfolio should be a mix of different assets, like shares, property and bonds, and the allocation should be determined by your risk tolerance and cashflow needs.

It’s also worth speaking with a financial adviser as they can review your overall investment performance and allocation to make sure it aligns with your goals.

4. Add more into super

If you’re not already retired, adding a little extra into your super fund each month is one of the best ways you can beat inflation and build your retirement savings at a consistent and steady rate.

5. Hold on to some cash

It’s important to have cash reserves in the event of an emergency. By having a savings account separate from your investments, you don’t have to tap into any equities or other assets if you need money.

6. Calculate retirement needs as early as possible

Factoring inflation into your retirement plans early on means you’ll be better equipped to afford price increases later down the track.

What MLC is doing to protect members from inflation

MLC’s diversified investment strategy ensures members’ money is invested across many asset classes, industries and sectors. This helps to reduce the impact of market falls.

Each investment option also aims to achieve returns above the rate of inflation. While this is not always guaranteed, we try to ensure your retirement savings don’t just keep pace with inflation but grow above it.

Seek help from a professional

If you value the experience of experts in other aspects of your life, don’t discount it when it comes to managing your life savings.

Financial advisers can help you with all aspects of your financial life—savings, insurance, debt—while keeping you on track to achieve your goals.

More importantly, they can answer questions like:

-

What age can I stop working and retire?

-

What strategies can I use to build my wealth?

-

How can I ensure my wealth is transferred to my children?

See how we can help you by calling us on 02 9554 3566.

Source: MLC August 2022

Important information and disclaimer

This article has been prepared by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) as trustee of the MLC Super Fund ABN 70 732 426 024. NULIS is part of the group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (‘Insignia Financial Group’). The information in this article is current as at July 2022 and may be subject to change. This information may constitute general advice. The information in this article is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider obtaining independent advice before making any financial decisions based on this information. You should not rely on this article to determine your personal tax obligations. Please consult a registered tax agent for this purpose. Opinions constitute our judgement at the time of issue. The case study examples (if any) provided in this article have been included for illustrative purposes only and should not be relied upon for decision making. Subject to terms implied by law and which cannot be excluded, neither NULIS nor any member of the Insignia Financial Group accept responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in the information in this communication.