Key takeaways:

-

Determining how much annual income you’ll need to maintain your lifestyle in retirement is key

-

You also want to evaluate how much you’re likely to have by the time you retire, if you continue with your current savings strategy

-

If you find that you may fall short, there are things you can do to turn your situation around.

While many of us dream about the day we finally get to give up work and reap the benefits of our blood, sweat and tears, we often struggle to plan for it.

After all, in the scuffle of immediate priorities, saving and planning for retirement don’t always make it to the top of the pile.

But there’s a good chance you could be spending almost as long in retirement as you will be working. So, if you really want to end up with the retirement you envision, there are some things you can start doing right now.

1. Determine how much you’ll need

Determining how much annual income you’ll need to maintain your lifestyle in retirement is key and will depend on the type of lifestyle you want in retirement. For example, the types of holidays and frequency, where you’d like to live and your recreational activities.

Once you’ve estimated what your annual retirement income might be, you can start thinking about where you’ll be able to access it from such as your super, part-time work, or social security entitlements. You’ll also be able to determine your total amount of savings needed to meet your desired lifestyle.

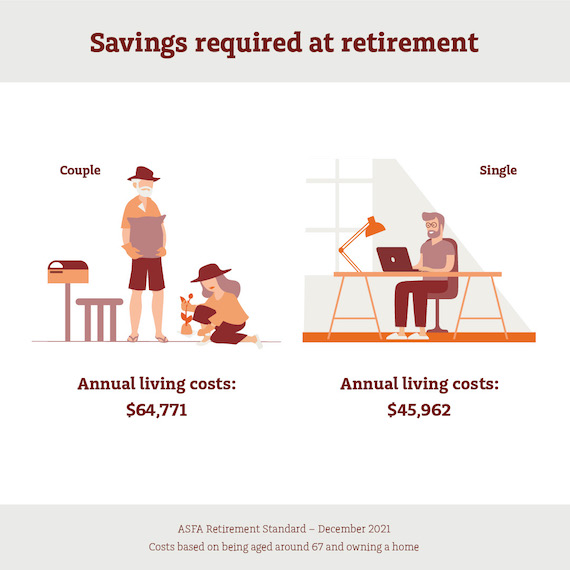

A comfortable retirement

If you’re after a comfortable retirement lifestyle which includes a good standard of living and recreational activities such as some overseas travel, The Association of Superannuation Funds of Australia (ASFA) recommends that couples would need an annual income of around $64,771, while for singles this would be approximately $45,926 (based on you owning your own home).

A modest retirement

If a simple retirement lifestyle—that’s slightly better than being on the Age Pension—is more on the cards, ASFA estimate you would need a much smaller annual amount at retirement. However, the amount you’ll need depends on your investment returns and the amount of Age Pension that you’re entitled to.

Based on your circumstances, you’ll need to determine what Age Pension or other social security benefits you might be entitled to in the future and ensure that your other sources or retirement income will be adequate to fund your desired lifestyle.

Rising cost of living

Keep in mind that while you’re likely to have fewer expenses in retirement—you won’t be contributing to your super, you might pay less tax and may have paid off your mortgage—inflation can eat away at your retirement savings.

For instance, if you choose to invest conservatively by having your portfolio solely focused on defensive assets like cash and bonds, your returns may not be enough to offset the rising cost of living.

2. Determine how long it will need to last

Once you have an idea of what your retirement lifestyle will cost, the challenge is to ensure your cash lasts the distance—however long that may be.

While no one can predict how long they’ll live, if we use the average life expectancy of 81.2 for males and 85.3 for females2, you can estimate spending around 20 years in retirement assuming you retire around 67.

3. Are you on track to reach the lifestyle you want?

The next step is to evaluate how much you’re likely to have by the time you retire, if you continue with your current savings strategy.

And this will come down to a variety of factors including:

-

Whether you own your home

-

Value of your super and other investments

-

Return you earn on those investments and income from other sources

-

Your spending habits.

To understand where you currently stand, you need to add up any savings/assets you hold inside and outside of super minus your debts. Then factor in your future earnings and what you can save from those earnings. There are retirement calculators available to help with this.

4. Not on track?

If you find that you may fall short in achieving your desired lifestyle on your projected savings, don’t panic. There are things you can do to turn your situation around.

Make additional super contributions

You can add more into your super on a regular basis using your before or after-tax income. Contribution caps are limit to the amount you’re able to contribute each year without paying additional tax.

If you make a personal contribution, you may be eligible to claim a tax deduction too. This means you’ll reduce your taxable income for the financial year and potentially pay less tax, while adding to your super balance. It’s a win-win!

Delay retiring or work part-time

If you’re flexible with your retirement date, one alternative is to consider delaying your retirement by continuing to work, or working part-time instead of retiring completely. Holding off your retirement, even for a few years, could significantly increase your retirement nest egg. And transitioning to by working part-time can help you prepare – financially, socially and emotionally – for what is a major change in your life. Even if you’re continuing to work part-time, you might still be eligible to receive a social security payment or benefit – such as a partial Age Pension to help supplement your reduced income.

Reduce your debt

Having no debt, or very manageable debt, will reduce your money worries in retirement. You may want to consider a plan to proactively clear your debt by reducing the amount you owe, thereby strengthening your financial position when you retire. However, it doesn’t always have to be all or nothing in terms of diverting your available funds to reducing debt or contributing to super for your retirement.

Speaking to a financial adviser can help determine the best way forward, to manage your debt leading into retirement, while also making sure your retirement goals are on track.

5. Seek professional support

If you value the experience of experts in other aspects of your life, don’t discount it when it comes to managing your life savings.

A financial adviser is not just someone who helps with investments. Their job is to help you with every aspect of your financial life—savings, insurance, tax, debt—while keeping you on track to achieve your goals.

More importantly, they can answer questions like:

-

What age can I stop working and retire?

-

What strategies can I use to build my wealth?

-

How can I ensure my wealth is transferred to my children?

If your to-do list is endless and you never quite have time to tackle your personal finances, a financial adviser may help to set you on the right track.

Start the conversation to see how we can help you. Call us on 02 9554 3566.

1 ASFA Retirement Standard – December quarter 2021 https://www.superannuation.asn.au/resources/retirement-standard

2 2020Australian Bureau of Statistics, 4 November 2021 – https://www.abs.gov.au/media-centre/media-releases/life-expectancy-hits-new-high

Important information and disclaimer

This article has been prepared by NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 (NULIS) as trustee of the MLC Super Fund ABN 70 732 426 024. NULIS is part of the group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (‘Insignia Financial Group’). The information in this article is current as at March 2022 and may be subject to change. This information may constitute general advice. The information in this article is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider obtaining independent advice before making any financial decisions based on this information. You should not rely on this article to determine your personal tax obligations. Please consult a registered tax agent for this purpose. Opinions constitute our judgement at the time of issue. The case study examples (if any) provided in this article have been included for illustrative purposes only and should not be relied upon for decision making. Subject to terms implied by law and which cannot be excluded, neither NULIS nor any member of the Insignia Financial Group accept responsibility for any loss or liability incurred by you in respect of any error, omission or misrepresentation in the information in this communication.